Payroll tax estimator

The formula is. 2020 Federal income tax withholding calculation.

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Robert Barresi Inc was founded in 1966 in the Bronx NY and has since then been providing excellent customer service for accounting prep insurance and payroll service.

. Summarize deductions retirement savings required taxes and more. Federal payroll tax rates for 2022 are. Ad Payroll So Easy You Can Set It Up Run It Yourself.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Your household income location filing status and number of personal. Shouldering the Burden of Doing Payroll Can Distract You from Your Main Duties.

SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Adjusted gross income Post-tax deductions Exemptions Taxable income.

Bloomberg Tax Expert Analysis Your Comprehensive Federal Tax Information Resource. Ad See How MT Payroll Services Can Help Streamline And Grow Your Business. Social Security tax rate.

Get Started With ADP Payroll. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local. Subtract any deductions and.

Luckily were here to give you some answers. Get Started With Limited Offers Today. Computes federal and state tax withholding for.

To calculate an annual. For post-tax deductions you can choose to either take the standard deduction. Use this payroll tax calculator to help get a rough estimate of your employer.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. Use this tool to. All Services Backed by Tax Guarantee.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Get the Latest Federal Tax Developments. Ad Process Payroll Faster Easier With ADP Payroll.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Discover ADP Payroll Benefits Insurance Time Talent HR More. All Services Backed by Tax Guarantee.

For example if an employee earns 1500 per week the individuals annual. Ad Get It Right The First time With Sonary Intelligent Software Recommendations. Our employer tax calculator quickly gives you a clearer picture of all the payroll taxes youll owe when bringing on a new employee.

Cooper Arias LLP Accounting Accountability 892 State Route 17B PO. Get Started With ADP Payroll. Free Unbiased Reviews Top Picks.

Subtract 12900 for Married otherwise. Check your tax withholding with the IRS Tax Withholding Estimator a tool that helps ensure you have the right amount of tax withheld from your paycheck. View FSA Calculator A.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Ad Process Payroll Faster Easier With ADP Payroll. Payroll Tax Calculator Determine the right amount to deduct from each employees paycheck.

Take Advantage of Everything Payroll Has To Offer. Ad Payroll Is Not Easy but Weve Got the Process down to a Fast and Easy Job. This number is the gross pay per pay period.

The rates have gone up over time though the rate has been largely unchanged since 1992. Learn More About Our Payroll Options. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Simplify Your Employee Reimbursement Processes. Gross Pay Calculator Plug in the amount of money youd like to take home. Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

Save time and gain peace of mind when you use our free payroll tax calculator to. How to calculate your paycheck This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. Ad Compare This Years Top 5 Free Payroll Software.

How To Calculate Payroll Taxes Methods Examples More

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Income Tax Calculating Formula In Excel Javatpoint

How To Calculate Income Tax In Excel

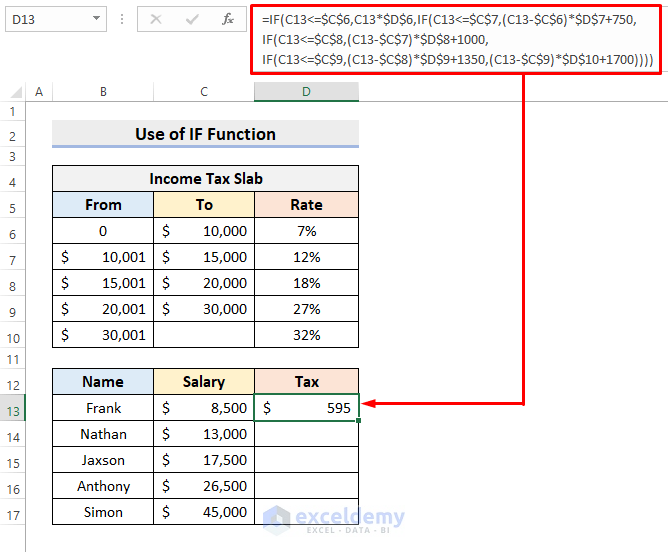

How To Calculate Income Tax In Excel Using If Function With Easy Steps

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Federal Income Tax

How To Calculate Income Tax In Excel

Taxable Income Formula Examples How To Calculate Taxable Income

How To Calculate Income Tax In Excel

Calculation Of Personal Income Tax Liability Download Scientific Diagram

Inkwiry Federal Income Tax Brackets

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

Payroll Tax Calculator For Employers Gusto

Calculate Income Tax In Excel How To Calculate Income Tax In Excel